Nigeria’s New Tax Laws: A New Dawn for the Economy?

On June 26, 2025, President Bola Tinubu signed off on four new tax laws that promise to “reshape Nigeria’s future,” at least according to the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele.

Translation? The taxman is getting organised—and possibly, more ambitious.”

So, what’s in the fine print? The four shiny new laws are

- Nigeria Tax Act

- Nigeria Tax Administration Act

- Nigeria Revenue Service (Establishment) Act

- Joint Revenue Board (Establishment) Act.

The new system is scheduled to officially kick off on January 1, 2026. If things go according to plan, Nigeria could finally have a more efficient, transparent tax setup that boosts revenue and maybe, just maybe, attracts investors.

Act I: The Great Simplification – The Nigeria Tax Act, 2025

The first is the Nigeria Tax Act, 2025. This is the heart of the reform. This act took a dozen different, often contradictory, rulebooks and replaced them with a single, comprehensive guide. It repealed iconic but dated laws like the Companies Income Tax Act, the Personal Income Tax Act, and the Value Added Tax Act, combining them into one unified piece of legislation.

For the first time, the rules for taxing companies, individuals, transactions, and assets are all in one place.

- For Private Individuals: If you earn ₦800,000 or less in a year (about ₦66,667 monthly), you no longer have to pay personal income tax. That means your entire income stays with you. For those earning above the threshold, the tax system is now progressive, which means the more you earn, the more tax you pay. But there’s a limit: the highest tax rate is capped at 25%, so it won’t swallow your entire income.

Another big change is that the 1% minimum tax on gross income has been removed. In the previous law, even people earning below the taxable limit still had to pay something. Now, if you don’t earn enough to be taxed, you get to keep it all. - For Small Businesses: If your business makes ₦100 million or less a year and has assets worth ₦250 million or below, you’re now classified as a “small company” and completely exempt from Company Income Tax, Capital Gains Tax, and the Development Levy.

Previously, the tax-free limit was set at ₦25 million, which excluded many small businesses from enjoying this relief. Now, doubling the threshold gives thousands of SMEs more room to grow, invest and survive in a tough economy.

One thing to note, though: professional service firms like law firms, auditors, and consultants don’t qualify for these benefits, even if they fall under the ₦100 million threshold. - For Large Corporations: Medium Companies no longer exist. Previously, companies were classified into three categories: small, medium and large.

The Act removes the “medium company” category entirely. Under the new system, companies earning ₦100 million or less are considered small and will pay 0% Company Income Tax (CIT). Companies earning above ₦100 million fall under a single large category and pay the standard 30% CIT. - Single Levy for Companies: The Act makes corporate taxes a bit simpler by replacing several small levies with one single payment: a 4% Development Levy on company profits.

Before now, companies had to pay for multiple things separately: the education levy, NASENI levy, IT levy, Police Trust Fund, and more. Now, all of that has been merged into one payment.

The idea is that the funds will go toward national priorities like student loans, technology, innovation, and security infrastructure. Whether the money will actually be managed well is another conversation, but at least the reporting process is now easier for businesses. - Rent Relief: You can now get tax relief on your rent. Under the new Rent Relief Allowance, if you’re a tenant, you can deduct 20% of your annual rent taxable income, but this is capped at ₦500,000. This reduces the amount of income that will be taxed.

However, the benefit only applies if you actually pay rent. Homeowners and people living rent-free with family do not qualify. To enjoy this relief, you must also provide proper documentation and receipts for your rent payments.

This one is tricky because under the old rules, everyone got a generous Consolidated Relief Allowance (CRA) that lowered taxable income, whether you rented or owned. That’s gone now, and only tenants get a relief. - On VAT: The Value Added Tax (VAT) rate remains at 7.5%, but there’s a key update; the list of zero-rated essentials has been expanded. Now, items like basic food products, school fees, books, medicines, electricity, and healthcare services attract no VAT at all.

The goal is to reduce the tax burden on households and make day-to-day living a bit easier, especially for low and middle-income Nigerians. It doesn’t automatically mean prices at the market will drop, but it’s meant to keep the cost of essentials from climbing even higher in an economy where every Naira counts. - On CGT: The rules around Capital Gains Tax just got stricter. The rate has jumped from 10% to 30% for big companies, bringing it in line with corporate tax rates. This means businesses selling assets like shares, property, or major investments will now hand over a larger share of their profits to the taxman.

On top of that, the Act closes a long-standing loophole: if Nigerian assets are sold indirectly through offshore holding companies, those sales are now taxable in Nigeria.

The goal is to stop profit-shifting and make sure the government captures revenue from big asset sales that used to slip through the cracks. - For Certain Sectors:

- Tech & Startups: The reforms strengthen incentives under the Nigeria Startup Act. Startups labelled under the Act can attract more funding since angel investors and VCs now enjoy tax-free capital gains if they hold investments for at least 24 months.

This aims to boost innovation and support the startup ecosystem. - Financial Services: Fintechs, digital banks, and mobile money platforms are now under closer watch.

The reforms tighten compliance for Virtual Asset Service Providers (VASPs) like crypto exchanges and wallet providers, requiring them to register with the SEC and submit monthly reports.

The goal is to improve transparency in the fast-growing digital payments and crypto space. - Creative Economy: For creators and remote workers, your earnings are no longer invisible.

The law now defines where your income is taxed and who handles the deductions, especially for payments from platforms and foreign clients.

It also targets digital platforms like YouTube, Fiverr, TikTok, Netflix, and other streaming or gig services.

The taxman now has a claim on any of these companies or platforms that make money from Nigerian users (through ads, subscriptions, commissions, or by paying Nigerians for their work). - Oil & Gas: The reforms close long-standing loopholes for offshore share transfers. If a company sells shares in an offshore entity that indirectly owns Nigerian oil or gas assets, that transaction is now taxable in Nigeria.

This targets companies routing deals abroad to avoid paying taxes locally. - Manufacturing & Consumer Goods: Manufacturers struggling with rising costs get a slight boost: companies that create jobs, export products, or earn foreign exchange can qualify for performance-based tax credits.

This encourages investments in local production and supports businesses driving Nigeria’s industrial growth.

- Tech & Startups: The reforms strengthen incentives under the Nigeria Startup Act. Startups labelled under the Act can attract more funding since angel investors and VCs now enjoy tax-free capital gains if they hold investments for at least 24 months.

Act II: The Rulebook – The Nigeria Tax Administration Act, 2025

If the Nigeria Tax Act is the “what,” then the Nigeria Tax Administration Act is the “how.” This law provides a single, standardised procedure for everything related to tax compliance. It’s the official rulebook that everyone, taxpayers and tax officers alike, must follow.

One of the biggest changes is the move toward digital-first compliance because the Act gives strong legal backing to the use of technology.

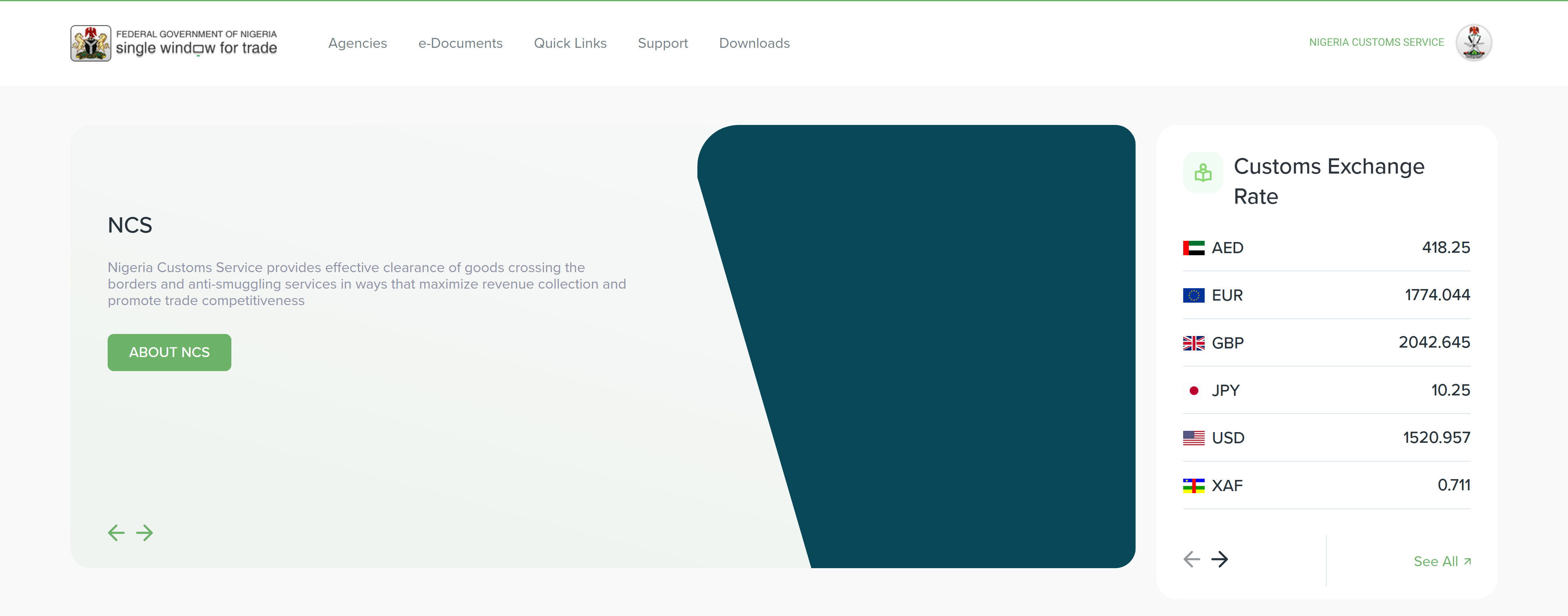

The Act now gives the Nigeria Revenue Service (NRS) full control to manage tax filings online. It also brings the National Single Window Trade Portal under the authority of the NRS (it is currently managed by the Nigeria Customs Service).

This means businesses can handle imports, exports, e-invoicing, and tax submissions on one connected platform instead of moving between multiple agencies. The goal is to make tax processes simpler, reduce human error, limit manipulation and improve transparency across the system.

Another key change lies in how VAT revenue is distributed. Under the new system, the Federal Government keeps 10 per cent, while State Governments receive 55 per cent and Local Governments get 35 per cent. The idea is to give states and LGAs more cash so they can handle schools, roads, healthcare, and community development at the local level.

However, the NTAA also raises the stakes for non-compliance. Penalties for late filing are now higher, starting at ₦100,000 for the first month and ₦50,000 for every additional month of delay. And since everything is going digital, the government can easily track who’s complying and who’s hiding. The days of quietly “forgetting” your returns are basically over.

The adoption of technology has given tax authorities more access than ever, leaving very little room for evasion or delayed reporting.

Act III: A New Sheriff in Town – The Nigeria Revenue Service (Establishment) Act,2025

To enforce this new, unified tax law, the Nigeria Revenue Service (NRS) Act transformed the old Federal Inland Revenue Service (FIRS) into a new, more powerful body. But this is not just a name change; it is a complete overhaul of how federal taxes are assessed, collected and enforced.

The NRS now oversees all federal taxes, which makes things easier for taxpayers since they now interface with a single authority instead of juggling multiple fragmented agencies. States, however, still manage their own taxes through their State Internal Revenue Services (SIRS).

The NRS will also work more closely with states and local governments. If requested, it can step in to help collect state-level taxes using its platforms and expertise, charging a small service fee for the support.

This collaboration aims to reduce duplication, minimise conflicting rules, and simplify the process for businesses navigating both federal and state requirements.

Additionally, the NRS now has the authority to collaborate with foreign tax authorities to track offshore income and enforce cross-border compliance. For individuals and companies using foreign structures to hide assets, the space to stay invisible is shrinking quickly.

Act IV: Building Bridges – The Joint Revenue Board (Establishment) Act, 2025

One of the biggest headaches for businesses operating across Nigeria was the friction between the Federal, State, and Local Government tax authorities. The Joint Tax Board had been set up to deal with the friction and ensure harmonisation, but it has had its challenges.

The Joint Revenue Board (JRB) Act sees to the transition of the Joint Tax Board to the Joint Revenue Board (JRB) with expanded scope and responsibilities that would make tax systems easily harmonised and modernised nationwide.

The Joint Revenue Board (JRB) Act was designed to be the great harmoniser. Its mandate is to create a seamless tax environment across the entire federation. It does this by:

- Integrating Databases: The JRB is setting up a single, unified database of Taxpayer Identification Numbers (TINs).

This means no more exploiting state-to-state loopholes or “disappearing” from one tax authority’s radar by moving to another jurisdiction. It also promotes joint audits between Federal, State, and Local authorities, so businesses are no longer hit with repeated, conflicting assessments. - Resolving Disputes: Conflicts between tax authorities have been a nightmare for years, especially for businesses operating in multiple states.

The JRB acts as a mediator to settle these disputes quickly and fairly, whether it’s disagreements over which state gets your taxes or conflicting assessments between Federal and State authorities. - Championing Taxpayer Rights: Most importantly, the Act establishes the Tax Ombudsman and revamps the Tax Appeal Tribunal (TAT).

The Ombudsman gives individuals and businesses an independent, cost-effective channel to file complaints against tax authorities, while the TAT now has broader powers and strict timelines.

In short, the JRB serves as the referee at the centre of Nigeria’s tax system, working to integrate taxpayer data, settle disputes, protect rights and improve transparency.

Conclusion

Together, these four Acts represent more than just a tax reform; they signal a fundamental shift in Nigeria’s economic philosophy.

The narrative is no longer one of complexity and uncertainty, but one of simplification, clarity, and fairness. And no matter who you are, a salary earner, a small business owner, or a big company boss, these reforms will reach you. It could show up in your rent, your shopping cart or on your payslip.

The promise is simplicity, fairness and clarity, but the real test lies in execution. Will the NRS make compliance smoother? Will the JRB finally fix the endless Federal-versus-State battles? Will VAT cuts and rent relief actually put more money back in your pocket? Time will tell, and we’ll be watching.

Credits

Chimamanda Augustine & Omolola Ambrose.

If you like what you just read, don’t stop here! Follow us on Twitter and Instagram or subscribe to our newsletter to stay updated every time we share new content.

Want to take it a step further? Join our WhatsApp community and be part of the conversation in real time! Let’s keep the energy going together.

ALSO READ: How to Be an Active Citizen: Get Involved, Stay Informed!